Protect Your Truck, Your Way – A Clear Guide to Physical Damage Insurance from DSB Insurance

Hey there trucking pros! From the team here at DSB Insurance Agency, we know your world revolves around keeping those wheels turning and the freight moving. Your truck and trailer? They’re not just equipment; they’re the heart of your operation, your mobile command center, and a serious investment. That’s why we’re not just about policies; we’re about partnerships, and today, we’re diving into a crucial piece of your protection puzzle: Physical Damage Insurance.

You’re out there conquering highways and byways. But let’s be real, life on the road can throw curveballs – a rogue deer, an unexpected hailstorm, or even a fender bender in a tight loading dock. When these “oops” moments happen, DSB Insurance wants you to know that Physical Damage coverage is your first line of defense for your iron.

So, What’s the Deal with Physical Damage?

At DSB, we like to keep things clear and straightforward. Physical Damage insurance isn’t about the cargo (that’s for Motor Truck Cargo coverage, which we also rock at!) or if you’re liable for hitting someone else (hello, Primary Auto Liability – another DSB specialty!). Nope, this coverage is all about protecting your truck and your trailer from, well, physical damage.

It generally comes in two main flavors:

- Collision Coverage:

- The DSB Lowdown: This is for when your truck or trailer has an unfortunate meeting with another object (another vehicle, a stationary object like a pole) or if it decides to take an unscheduled nap on its side (overturns).

- Think: The “uh-oh, that wasn’t supposed to happen” moments.

- Real-World Example: You’re navigating a tricky yard, and your trailer kisses a concrete barrier. Or, someone merges into your lane a little too aggressively. Collision coverage, sourced through your partners at DSB, helps get those repairs handled.

- Comprehensive Coverage (Often called “Comp”):

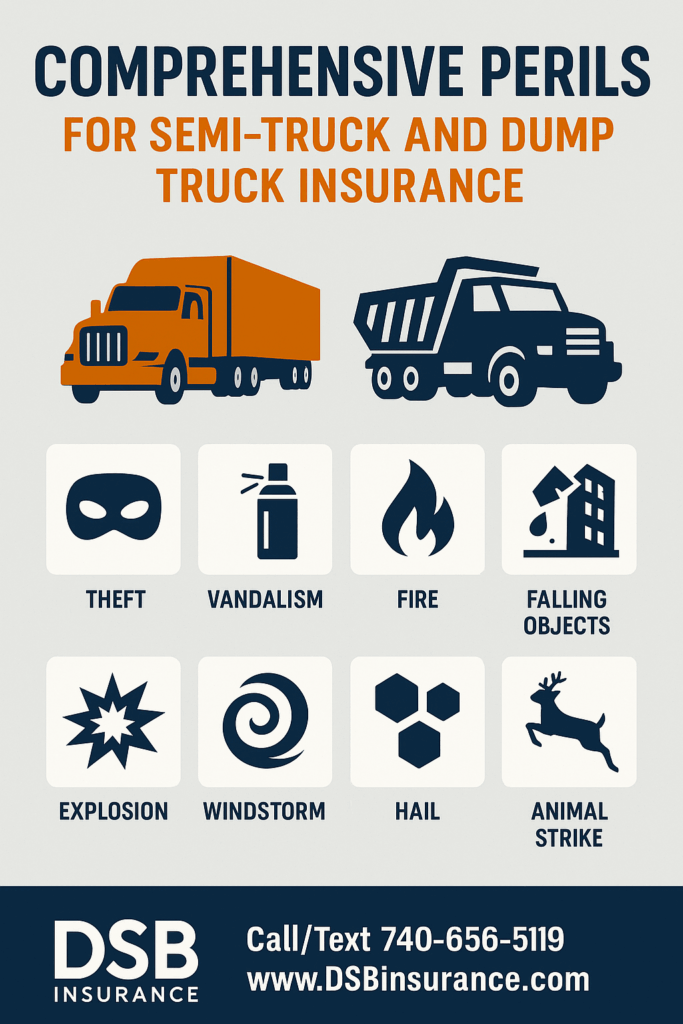

- The DSB Lowdown: This is your shield against almost everything else that isn’t a direct collision. It’s for the unpredictable.

- Think: Acts of nature, theft, vandalism, fire, animal encounters (those deer again!), falling objects.

- Real-World Example: A surprise hailstorm leaves your cab looking like a golf ball. Vandals decide your trailer needs some unwanted “art.” Or, worst-case, your rig is stolen. Comprehensive coverage, expertly sourced by DSB, steps in.

Why is Physical Damage a Non-Negotiable?

We’ve seen it all at DSB Insurance Agency, and trust us, robust Physical Damage coverage is more than just a good idea:

- Protect Your Hard-Earned Investment: Your rig is likely one of your biggest business expenses. We help you safeguard it.

- Meet Lender Mandates: Financing your truck or trailer? Your lender will insist on Physical Damage coverage. We make sure you meet those requirements seamlessly.

- Slash Downtime, Boost Uptime: Repairs are expensive and can sideline your operation. With the right DSB-backed policy, you can expedite repairs and get back to earning.

- Drive with DSB Peace of Mind: Knowing your equipment is properly insured lets you focus on your route and your business, not “what if” scenarios.

Don’t Let Your Trailer Feel Left Out!

Your power unit is vital, but that trailer tagging along is just as important to your bottom line. At DSB, we ensure all your assets are considered:

- Owned Trailers: We’ll help you bundle Physical Damage for your owned dry vans, reefers, flatbeds, etc., right alongside your truck.

- Non-Owned Trailers / Trailer Interchange: If you’re pulling trailers you don’t own (common for power-only units or under interchange agreements), you need Trailer Interchange Insurance. This is a specialized physical damage coverage that DSB understands inside and out, protecting the trailer owner’s property while it’s under your watch.

Key Considerations When Partnering with DSB on Physical Damage:

When you work with DSB Insurance Agency, we’ll walk you through the nitty-gritty, ensuring you understand:

- Actual Cash Value (ACV) vs. Stated Amount:

- ACV: Pays the current depreciated market value.

- Stated Amount: An agreed-upon maximum value.

- The DSB Difference: We’ll help you analyze your equipment to determine the most appropriate valuation method, ensuring your Stated Amount is accurate and fair, preventing underinsurance.

- Deductibles: The portion you pay before insurance kicks in.

- The DSB Difference: We’ll help you find the sweet spot – a deductible you can manage that also keeps your premiums competitive. No surprises.

- Exclusions: Every policy has them.

- The DSB Difference: Transparency is key. We’ll clearly explain any exclusions so you know exactly what’s covered and what’s not.

DSB Insurance: Your Full-Service Trucking Insurance Partner

While Physical Damage is a cornerstone, it’s one part of the comprehensive protection strategy we build for our trucking clients at DSB. We also specialize in:

- Primary Auto Liability

- Motor Truck Cargo

- Bobtail Insurance

- Trailer Interchange

- General Liability

- And a whole lot more, all tailored to your unique operation.

Ready to Experience the DSB Insurance Difference?

Navigating the world of trucking insurance can feel complex, but with DSB Insurance Agency by your side, it’s a smooth ride. We’re not just agents; we’re your dedicated advisors, committed to finding you the best coverage at the best value. We speak your language and understand the road ahead.

Don’t leave your livelihood to chance. Let the experts at DSB Insurance ensure your rig, your trailer, and your business are protected.

Get Your Personalized DSB Insurance Trucking Quote Today!

Give us a call/text at 740-656-5119 or visit our office at 95 N. Mulberry St., Suite E, Chillicothe, OH 45601. We’re here to help you drive forward with confidence.

With DSB Insurance, you’re not just covered; you’re cared for. Drive safe!