Is Your Work Life Insurance Really Enough? A Local Perspective from Your Neighbor at DSB Insurance

Here in the Chillicothe area, we’re fortunate to have great employers who offer valuable benefits like group life insurance. It’s a fantastic perk that provides a foundational layer of security for your family, often at little to no cost.

But I’ve seen it happen too many times: families believe this coverage is a complete solution, only to discover its limitations when it’s too late.

My name is Jason D. Brown, and as a Certified Insurance Counselor (CIC) right here in town, my goal at DSB Insurance Agency is to help my neighbors protect what matters most. Think of your group policy as a good start, but not the finish line. Let’s talk about why a personal policy isn’t just an add-on, but a necessity.

The Hard Truth About Employer-Provided Insurance

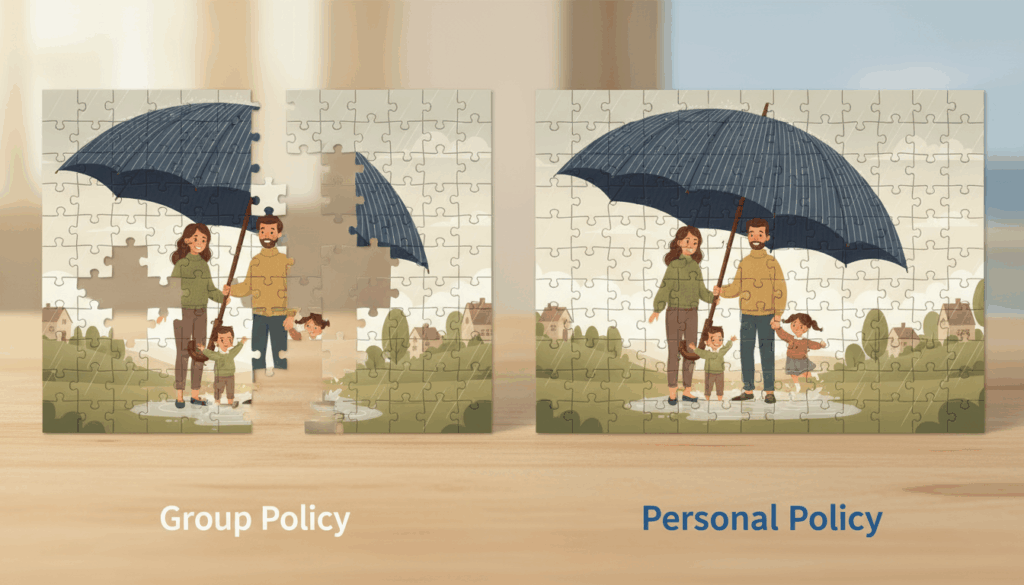

Your group policy is a great benefit, but it comes with three critical limitations you need to be aware of.

- It’s Not Truly Yours: Your employer owns and controls the policy. They can change the terms, reduce the coverage, or even eliminate the benefit entirely. You have no say in these decisions.

- The Coverage is One-Size-Fits-All: Group plans typically offer a death benefit of 1-2 times your salary. For many families, that’s simply not enough to cover a mortgage, fund college education, and replace years of lost income. It’s a temporary patch, not a long-term solution.

- You Can’t Take It With You: This is the biggest risk. If you change jobs, get laid off, or retire, that coverage disappears. You could be left searching for a new policy at an age when it’s far more expensive, or worse, after a health issue makes you uninsurable.

Three Stories, One Common Problem

These aren’t just hypotheticals; they are real-life situations I help people navigate.

- The Career Change: Sarah, a 45-year-old, left her job to start her own business. The day she resigned, her group life insurance ended. A few months later, a surprise health diagnosis made getting a new, affordable policy nearly impossible. A personal policy would have stayed with her, providing continuous protection.

- The Growing Family: Mark and his wife just bought a new home and welcomed their second child. His $100,000 group policy seemed substantial until they calculated their new mortgage and future expenses. It would barely last two years. An additional personal policy gave them the peace of mind that their family could maintain their home and lifestyle, no matter what.

- The Unexpected Layoff: David, 55, was unexpectedly laid off. He lost his job and his life insurance in the same day. Because of his age and some minor health issues, a new policy was significantly more expensive than it would have been a decade earlier. A personal policy would have locked in his rate and his insurability.

Take Control with a Policy You Own

An individual life insurance policy is your personal financial safety net. You own it. You control it. It stays with you.

You choose the coverage amount that truly fits your family’s needs, ensuring the mortgage is paid, college is funded, and your loved ones are secure.

Don’t leave your family’s future in someone else’s hands. Let’s review your current coverage and build a plan that provides true, lasting security.

We currently offer life insurance through Auto Owners, Kansas City Life as well as many others. Get more information –> HERE. Please feel free to reach out with any questions.