Comprehensive vs. Collision Coverage: What’s the Real Difference?

When you’re shopping for car insurance, “full coverage” is a term often thrown around, but it’s not actually a specific policy type. Instead, it usually refers to a combination of state-mandated liability insurance plus two critical optional coverages: Collision and Comprehensive. Understanding the difference between these two is vital to ensuring you aren’t left paying out of pocket when the unexpected happens.

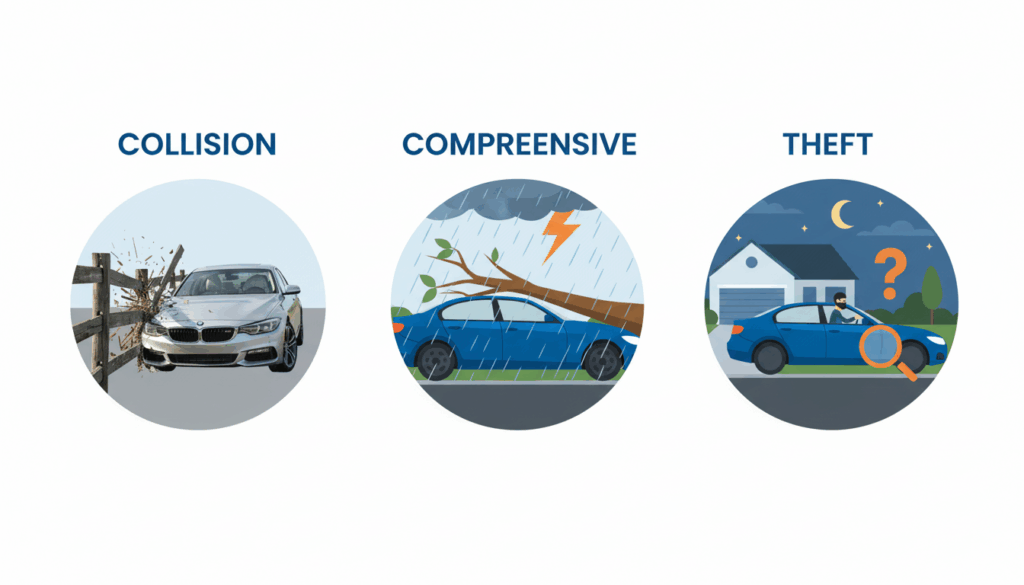

What is Collision Coverage? Think of Collision Coverage as protection for accidents where you are the driver. It covers damage to your vehicle resulting from a collision with another object. This applies regardless of who is at fault.

- Common Scenarios: Hitting another car, backing into a pole, or sliding on ice into a guardrail.

- Key Takeaway: If your car hits something, Collision pays to fix it (minus your deductible).

What is Comprehensive Coverage? Comprehensive Coverage (often called “Comp” or Other Than Collision) covers damage to your vehicle that is not caused by a collision. It protects you against factors often outside of your control.

- Common Scenarios: Theft, vandalism, fire, falling objects (like a tree branch), natural disasters (hail, floods), and hitting an animal (like a deer).

- Key Takeaway: If something happens to your car (other than a crash), Comprehensive usually covers it.

The Key Differences at a Glance

| Feature | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| Primary Trigger | You hit an object or vehicle | An event happens to your vehicle |

| Fault Required? | No (covers you even if at fault) | N/A (usually non-driving incidents) |

| Common Claims | Fender benders, single-car accidents | Hail damage, deer strikes, stolen cars |

| Cost | Generally more expensive | Generally less expensive |

3 Common Misconceptions About Auto Coverage

- “I have ‘Full Coverage,’ so everything is 100% free.”

- Reality: Even with comprehensive and collision, you still have a deductible. If your deductible is $500, you pay that amount first before the insurance company covers the rest of the repair bill.

- “If I hit a deer, it falls under Collision.”

- Reality: Surprisingly, hitting an animal is almost always covered under Comprehensive. Insurance companies view this as an unpredictable act of nature rather than a driving error.

- “My old car needs both coverages.”

- Reality: If your vehicle is older and its value has depreciated significantly, the cost of premiums for collision and comprehensive might exceed the payout you’d get in a total loss. It’s worth doing the math (the “10% rule”) to see if dropping them makes financial sense.

Choosing the right coverage is a balancing act between your budget and your peace of mind. By understanding the distinct roles of collision and comprehensive insurance, you can build a policy that truly protects your financial journey.

Related Articles:

Insurance Information Institute comprehensive vs collision coverage